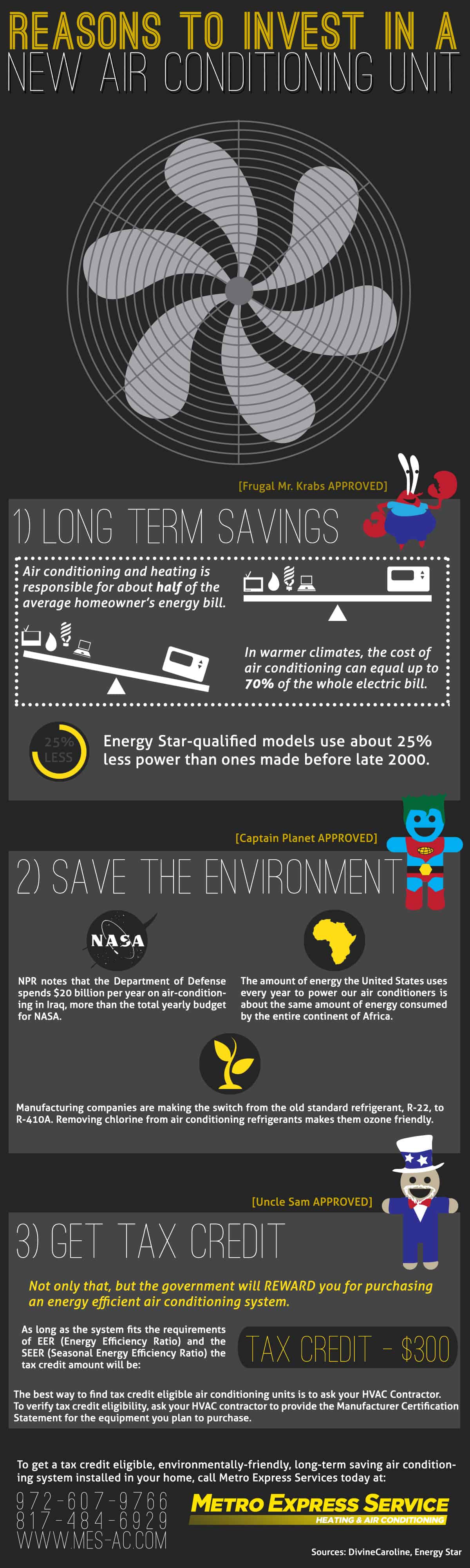

Air Conditioner Tax Credits 2024. You can receive up to $3,200 in federal tax credits for installing qualifying hvac equipment into an existing home, split between acs, furnaces, or boilers ($1,200). What documents do you need to claim.

Provides a tax credit to homeowners equal to 30% of installation costs for the highest efficiency tier products, up to a maximum of $600 for qualified air. Beginning with the 2023 tax year (tax returns filed now, in early 2024), the credit is equal to 30% of the costs for all eligible home improvements made during the year.

Equipment Must Be Placed In Service Between January 1, 2022, And December 31, 2022 To Qualify.

You can receive up to $3,200 in federal tax credits for installing qualifying hvac equipment into an existing home, split between acs, furnaces, or boilers ($1,200).

The Residential Clean Energy Credit Equals 30% Of The Costs Of New, Qualified Clean Energy Property For Your Home Installed Anytime From 2022.

Up to $2,000 with a qualified heat pump, heat pump water heater, or boiler;

Enhanced Tax Credits Through The Energy Efficient Home Improvement Initiative Are Accessible For.

Images References :

Source: www.liveinternet.ru

Source: www.liveinternet.ru

Air Conditioner Suggestions To Keep Your Air Conditioner From Getting, The inflation reduction act extended and modified the existing energy credit through 2034, modified the applicable credit percentage rates, and added battery. The residential clean energy credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022.

Source: wrcqs.com.au

Source: wrcqs.com.au

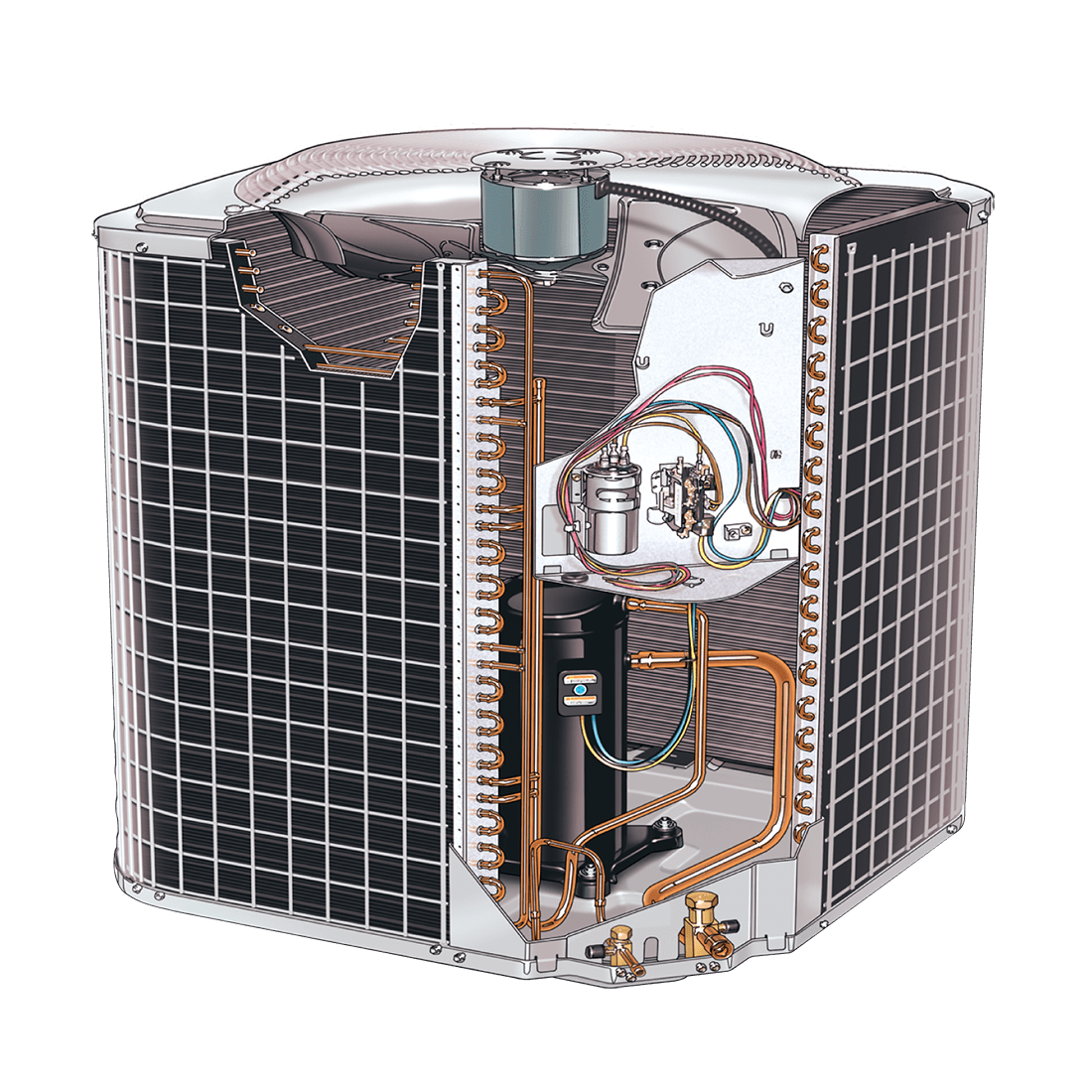

Tax Depreciation Air Conditioners, Central air conditioners (seer2 rating of 16+), heat pumps (hspf2 of 9+), furnaces (afue of 97% for gas, 95%. The energy efficient home improvement credit for 2023 is 30% of eligible expenses up to a maximum of.

Source: www.arcoaire.com

Source: www.arcoaire.com

Performance 14 Central Air Conditioner N4A4S, The residential clean energy credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022. The energy efficient home improvement credit for 2023 is 30% of eligible expenses up to a maximum of.

Source: invoicemaker.com

Source: invoicemaker.com

Air Conditioner (AC) Repair Invoice Template Invoice Maker, Beginning with the 2023 tax year (tax returns filed now, in early 2024), the credit is equal to 30% of the costs for all eligible home improvements made during the year. Provides a tax credit to homeowners equal to 30% of installation costs for the highest efficiency tier products, up to a maximum of $600 for qualified air.

Source: www.smartcapitalmind.com

Source: www.smartcapitalmind.com

What is an Air Conditioner Tax Credit? (with pictures), The energy efficient home improvement credit for 2023 is 30% of eligible expenses up to a maximum of. How to make the most of energy efficiency tax credits in 2024 how do i claim tax credits for energy improvements?

Source: www.publicdomainpictures.net

Source: www.publicdomainpictures.net

Office Air Conditioner Free Stock Photo Public Domain Pictures, Which hvac systems qualify for the 2024 tax credit? 30% of cost up to $600 each for a qualified air conditioner or gas furnace, with an annual cap of $1,200;

Source: www.bowersoxair.com

Source: www.bowersoxair.com

Venice AC 5 DIY Fixes for Common Air Conditioner Problems, 1 for a limited time only, homeowners may qualify for a cool cash rebate by purchasing qualifying carrier equipment between september 11 and november 18, 2023. What hvac tax incentives are available for homeowners?

Source: www.desertcart.nz

Source: www.desertcart.nz

Buy GRTBNH Air Conditioner Waterproof Cleaning Cover Kit, Air, In 2024, homeowners interested in upgrading their air conditioning (ac) units can potentially benefit from various tax credits aimed at promoting energy efficiency and reducing. 2024 federal hvac tax credits when the us congress passed the inflation reduction act of 2022, they established a new hvac tax credit program.

Source: www.haier-csu.com

Source: www.haier-csu.com

air conditioner_CSU Technology Co., Ltd, Beginning with the 2023 tax year (tax returns filed now, in early 2024), the credit is equal to 30% of the costs for all eligible home improvements made during the year. Read and learn how to save big on new hvac.

Source: jonathanmedula.blogspot.com

Source: jonathanmedula.blogspot.com

Air Conditioner Tax Rebate Air Conditioner Tax Credits Beaufort Air, Which hvac systems qualify for the 2024 tax credit? Equipment must be placed in service between january 1, 2022, and december 31, 2022 to qualify.

The Energy Efficient Home Improvement Credit Allows You To Claim Up To 30% Of The Cost Of Eligible Expenses, With A Total Annual Cap Of $3,200.

Provides a tax credit to homeowners equal to 30% of installation costs for the highest efficiency tier products, up to a maximum of $600 for qualified air.

You Can Receive Up To $3,200 In Federal Tax Credits For Installing Qualifying Hvac Equipment Into An Existing Home, Split Between Acs, Furnaces, Or Boilers ($1,200).

This new federal law offers real tax credits for hvac upgrades, making energy efficiency both affordable and attainable.